Icahn Enterprises L.P.

News

I Wouldn't Touch This Ultra-High-Yield Dividend Stock With a 10-Foot Pole. Here's Why.

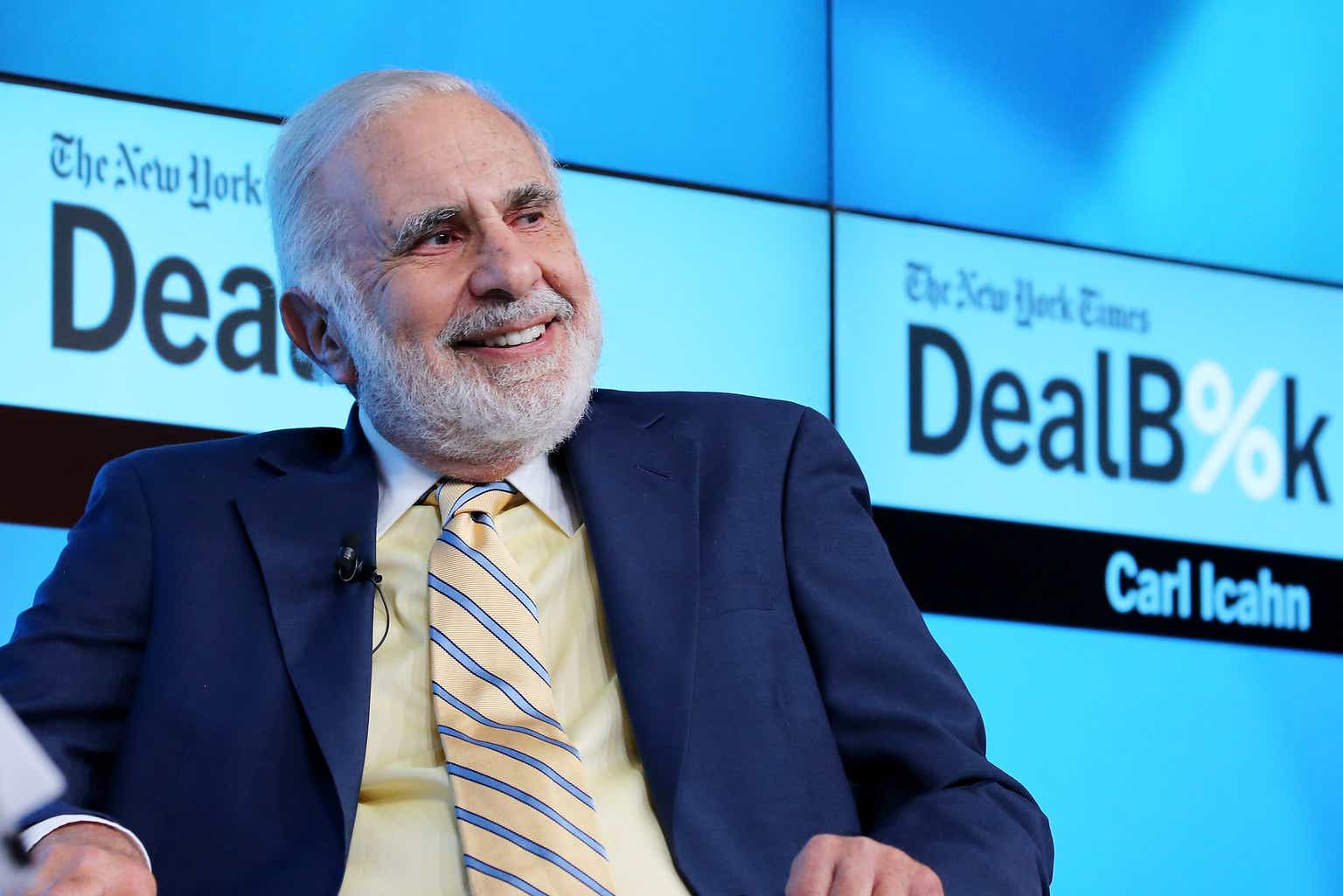

Fool.com Headlines Icahn Enterprises (NASDAQ: IEP), headed by activist investor Carl Icahn, has paid out a very appealing dividend yield for years. However, the stock has been under significant pressure since last year...\n more…

Looking At Icahn Enterprises's Recent Unusual Options Activity

Benzinga Investors with a lot of money to spend have taken a bullish stance on Icahn Enterprises IEP. And retail traders should know. We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga. Whether these are institutions or just wealthy individuals, we don't know.\n more…

Icahn Enterprises L.P. (NASDAQ:IEP) Sees Significant Increase in Short Interest

Ticker Report Icahn Enterprises L.P. (NASDAQ:IEP - Get Free Report) saw a large growth in short interest during the month of August. As of August 15th, there was short interest totalling 8,840,000 shares, a growth...\n more…

Icahn Enterprises: The 29% Yield Gets Even More Questionable

SeekingAlpha Icahn Enterprises: The 29% Yield Gets Even More Questionable...\n more…